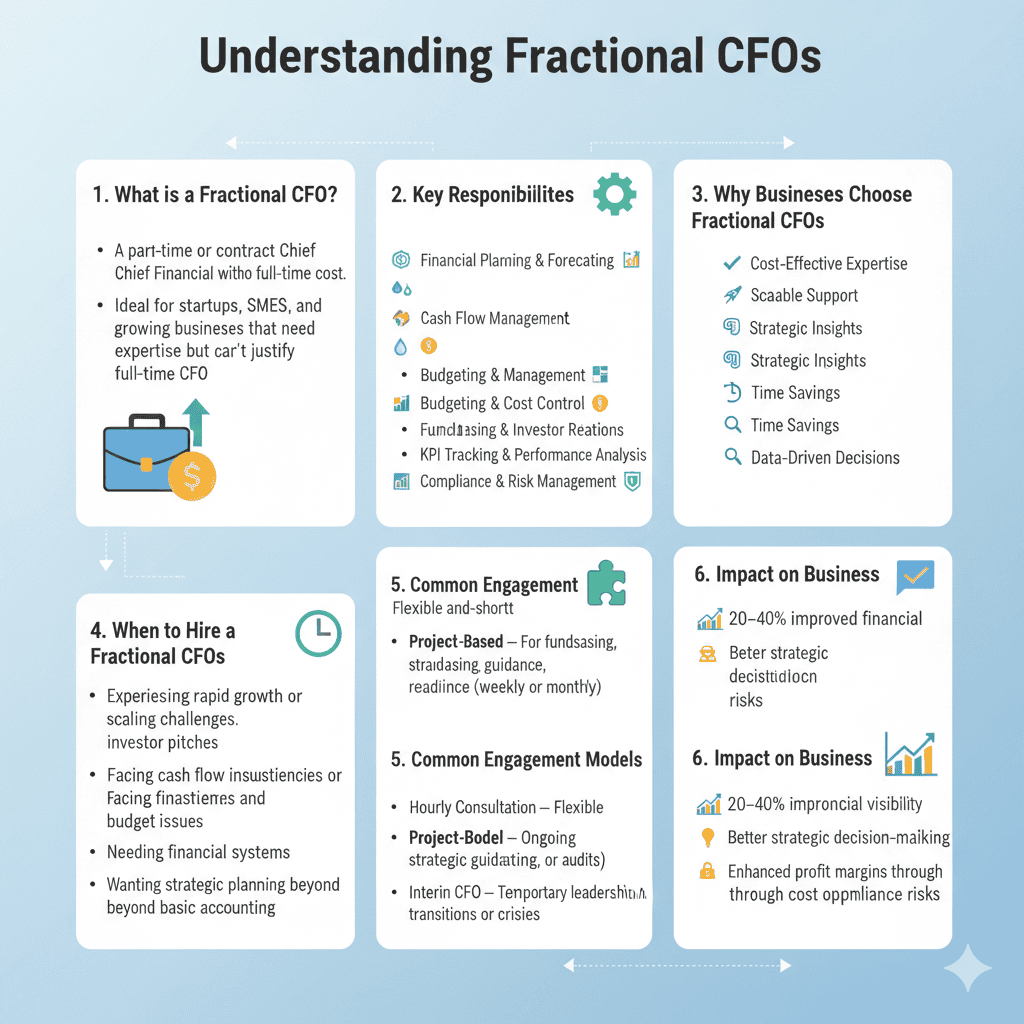

What is a fractional CFO, and it purpose? Running a business is tough. You’ve got a million things to juggle, and sometimes, the financial side of things can feel like a whole other language. That’s where a fractional CFO comes in. Think of them as your part-time financial expert, ready to help steer your company in the right direction without you needing to hire a full-time executive. They bring big-picture thinking and practical financial skills to the table, especially when you need it most.

Key Takeaways

- A fractional CFO is an experienced financial expert who works with businesses on a part-time or contract basis, offering high-level guidance without the cost of a full-time hire.

- They help tackle specific financial challenges, like cash flow problems or outgrown systems, and support growth goals such as raising capital or preparing for mergers.

- Hiring a fractional CFO gives you access to top-tier financial knowledge and a fresh perspective that can benefit any business, even those with an existing finance team.

- This flexible arrangement is ideal for companies needing strategic financial planning, forecasting, and cash flow management, especially during key growth phases or when facing complex financial situations.

- Ultimately, a fractional CFO services provides cost-effective financial leadership, helping businesses maximize their financial potential and achieve sustainable growth by making smarter, data-driven decisions.

What Is a Fractional CFO and its Role?

So, what is a fractional CFO? Think of them as a seasoned financial pro who lends their brainpower to your business, but not full-time. They’re not on your payroll 40 hours a week like a regular employee. Instead, they work with you on a part-time, retainer, or project basis.

This means you get all the smarts and experience of a high-level financial executive without the hefty price tag of a full-time hire, which includes salary, benefits, and all that jazz. They’re basically a financial expert on demand.

A Part-Time Financial Expert

Unlike a traditional CFO who’s in the trenches daily, a fractional CFO steps in when and where you need them most. They’re not bogged down with every single financial task. Their role is usually tailored to specific challenges or goals your company is facing. It’s about getting targeted financial wisdom without the overhead.

Beyond The Full-Time Hire

This isn’t just about saving money, though that’s a big plus. A fractional CFO brings a different kind of value. They often have experience across various industries and have seen a lot of different business situations.

This broad perspective can be incredibly helpful, especially for smaller businesses that might not have the budget for a full-time executive. You’re essentially getting a seasoned pro who can help you avoid common financial pitfalls.

Bridging The Gap in Financial Expertise

Many companies, especially startups or growing businesses, find themselves in a spot where they need advanced financial strategy but can’t justify a full-time CFO. That’s where the fractional CFO shines.

They fill that gap, providing the strategic financial leadership needed to help you grow and manage your money smartly. They can help with everything from getting your books in order to planning for future growth.

What Does a Fractional CFO Actually Do?

So, what exactly is it that a fractional CFO does day-to-day? It’s not just about crunching numbers, though that’s a big part of it. Think of them as your part-time financial expert, stepping in to tackle specific issues or drive particular goals.

They’re brought in when a company needs serious financial smarts but maybe can’t justify or afford a full-time hire just yet. They help sort out tricky financial knots, map out paths to growth, and bring a fresh set of eyes to your business.

Tackling Tough Financial Hurdles

Sometimes, businesses hit a wall. Maybe cash flow is tighter than a drum, expenses are creeping up faster than you can track them, or the accounting systems you’ve been using are starting to feel like they belong in the Stone Age.

This is prime time for a fractional CFO. They can jump in and figure out what’s going on, whether it’s a cash flow problem, margin issues, or just outgrowing your current setup.

They’re the ones who can help you make those tough decisions, like where to trim costs without hurting the business, or how to get your books in order so you actually know what’s happening financially.

Driving Towards Growth Goals

Beyond just fixing problems, a fractional CFO is all about moving the needle forward. Got big plans to expand, launch a new product, or maybe even sell the company?

They’re your go-to. They can help prepare your business for things like raising money from investors, whether it’s debt or equity.

This often involves getting all your financial documents polished, creating solid forecasts, and even helping you understand the nitty-gritty of term sheets and contracts. They’re focused on making sure your finances are set up to support your ambitions.

Bringing A Fresh Perspective

One of the coolest things about bringing in a fractional CFO is the outside view they provide. They’ve seen a lot, working with different companies and industries. This means they can spot opportunities or risks that might be invisible to your internal team.

They can help you set up key performance indicators (KPIs) that actually matter, build better financial models, and generally offer advice that’s grounded in real-world experience. They act as a trusted advisor, helping you make smarter decisions for the long haul.

Here’s a quick look at some common areas they help with:

- Sorting out cash flow crunches

- Improving profit margins

- Getting ready for mergers or acquisitions (M&A)

- Preparing business plans and pitch decks for investors

- Setting up better financial reporting and analysis

- Negotiating important contracts and leases

The Perks of Hiring a Fractional CFO

Access To Top-Tier Expertise

Think about it: you get a seasoned financial pro, someone who’s seen it all, without having to shell out for a full-time salary, benefits, and all the other stuff that comes with a permanent hire.

It’s like having a super-smart financial strategist on call, ready to tackle your biggest money questions. This isn’t just about having someone crunch numbers; it’s about bringing in someone who can actually guide your business forward.

They’ve likely worked with a bunch of different companies, so they bring a wide range of ideas and solutions that your internal team might not have thought of. It’s a smart way to get high-level financial brainpower when you need it.

Cost-Effective Financial Leadership

This is a big one for most businesses, especially smaller ones or those in growth phases. Instead of a hefty annual salary for a full-time CFO, you’re paying for the hours or services you actually use.

This makes top-notch financial guidance accessible even if you’re not quite ready for a permanent, in-house executive.

It’s a much more flexible model than hiring a full-time person, and it means your money is being spent on actual financial strategy and problem-solving, not just overhead. You get the benefits of an outsourced financial controller without the long-term commitment.

Strategic Guidance When You Need It Most

Sometimes, you just need a fresh pair of eyes on your finances, especially when you’re facing a big decision or a tricky situation. A fractional CFO can step in, offer objective advice, and help you see the path forward more clearly.

They aren’t bogged down by the day-to-day internal politics, so they can focus purely on what’s best for the company’s financial health and growth. Whether you’re planning to raise capital, merge with another company, or just trying to get your cash flow in better shape, they bring that focused, strategic input.

Here’s what you can expect:

- Objective Financial Analysis: Get an unbiased look at your numbers and strategies.

- Actionable Insights: Receive clear recommendations you can actually implement.

- Scalable Support: Adjust the level of support as your business needs change.

Hiring a fractional CFO means you’re not just getting a number cruncher; you’re gaining a strategic partner who can help steer your company towards its goals. They bring a level of experience that’s hard to find and afford in a full-time role, especially for growing businesses.

When Is A Fractional CFO The Right Move?

So, you’re wondering if bringing on a fractional CFO is the right call for your business. It’s a smart question to ask! Think of it this way: sometimes, you just need a seasoned pro to help steer the ship through choppy waters or to get you to the next big destination. It’s not always about needing a full-time captain but rather having the right expertise for specific moments.

Navigating Specific Financial Challenges

Does your company feel like it’s constantly putting out financial fires? Maybe cash flow is a headache, or your expenses seem to be creeping up faster than you can manage. Perhaps you’ve outgrown your current accounting software and need a better system. These are all classic signs that a fractional CFO can step in. They’re great at tackling issues like:

- Cash flow crunches

- Shrinking profit margins

- High operating costs

- Outdated financial systems

- The need for significant cost reductions

- Dealing with audits

These aren’t just minor bumps; they’re often roadblocks that can seriously slow down your growth. A fractional CFO can help you get your financial house in order and create a clear path forward. They can also act as an interim financial executive if you have a specific, short-term need.

Sometimes, the best way to solve a complex financial problem is to bring in someone who has seen it all before. They can offer a fresh perspective and proven strategies that your internal team might not have encountered yet.

Preparing For Major Business Milestones

Got big plans? Maybe you’re looking to raise money, sell the company, or merge with another business. These kinds of big moves come with a lot of financial heavy lifting.

A fractional CFO is invaluable here. They can help get your books ready, create solid financial forecasts, and even sit in on important meetings with investors or potential buyers. They bring a level of experience that can make all the difference when you’re dealing with term sheets, due diligence, and complex negotiations.

It’s about making sure you’re financially prepared for whatever comes next, whether that’s securing new debt and equity funding or navigating the sale of your business.

When Your In-House Team Needs Support

It’s not always about a lack of people; sometimes, it’s about a lack of specific skills or bandwidth. Your controller might be fantastic at managing the day-to-day, but perhaps they don’t have the strategic experience needed for long-term planning or fundraising.

A fractional CFO can work alongside your existing team, providing that high-level guidance and mentorship. They can help train your staff, implement new financial systems, and generally upgrade your company’s financial capabilities. This way, you get the benefit of top-tier financial strategy without the overhead of a full-time executive hire.

Key Services Offered by a Fractional CFO Services

So, what exactly does a fractional CFO get up to? Think of them as your go-to financial expert, but on a part-time basis.

They’re not just crunching numbers; they’re looking at the big picture and helping you get there. These pros bring a whole toolkit to the table, and it’s not just about keeping the books tidy. They’re focused on where you’re headed.

Strategic Planning and Forecasting

This is where the magic happens. A fractional CFO helps you map out your company’s financial future. They’ll work with you to create detailed plans, looking at the next 90 days, the rest of the year, and even the next few years.

This isn’t just guesswork; it’s about building a financial blueprint to hit your growth targets efficiently. They help you figure out how to get from point A to point B, making sure you’ve got the capital lined up and ready to go.

Capital Raising and Investor Relations

Got big plans that need funding? A fractional CFO can be a lifesaver here. They have experience helping companies secure debt and equity funding.

This means they can help you get your financial house in order, create compelling business plans and pitch decks, and even sit in on meetings with potential investors.

They’ll help you understand term sheets and contracts and generally make the whole process of raising money a lot less scary. It’s a big part of what a virtual CFO for small business often tackles.

Cash Flow Management and Optimization

This is a big one for any business, especially growing ones. A fractional CFO dives deep into your cash flow. They’ll help you spot potential issues before they become problems and figure out ways to keep money moving smoothly. This could involve anything from managing expenses to negotiating better terms with suppliers. Getting your cash flow right is key to staying afloat and growing.

Here’s a quick look at what this might involve:

- Developing short-, mid-, and long-term financial forecasts.

- Creating budgets based on those forecasts.

- Analyzing potential new products, services, or markets.

- Improving your overall financial health.

When you bring in a fractional CFO, you’re not just getting someone to balance your checkbook. You’re getting a strategic partner who can help you make smarter financial decisions, prepare for growth, and ultimately, build a more stable and profitable business. It’s a smart way to access high-level financial guidance without the full-time price tag, making it a great option for many businesses looking for part-time chief financial officer services.

Is A Fractional CFO Worth The Investment?

Maximizing Financial Potential

So, is bringing on a fractional CFO actually worth the cash? For a lot of growing businesses, the answer is a pretty solid yes. Think about it: you get someone with serious financial smarts, someone who’s seen it all, but you’re not shelling out for a full-time salary, benefits, and all that jazz.

It’s like hiring a top-tier consultant for specific projects, but on a more regular, ongoing basis. You’re essentially buying access to high-level financial strategy without the overhead of a permanent executive.

This means you can tackle complex issues, plan for the future, and make smarter decisions without breaking the bank.

Achieving Sustainable Growth

When you’re trying to grow, having a solid financial game plan is everything. A fractional CFO can help you get there. They can look at your numbers, figure out where the money is going, and help you find ways to make things more efficient.

This isn’t just about cutting costs; it’s about making sure your business is set up for long-term success. They can help you with things like:

- Figuring out your cash flow so you don’t run out of money unexpectedly.

- Creating realistic budgets and forecasts that actually help you plan.

- Identifying opportunities for growth, whether that’s expanding into new markets or launching new products.

- Getting your financial house in order before you try to raise money or sell the company.

Having a fractional CFO means you’re not just reacting to financial problems; you’re proactively building a stronger, more stable business. It’s about making sure your growth is sustainable, not just a flash in the pan.

The Value Beyond The Bottom Line

Beyond just the numbers, a fractional CFO brings a different kind of value. They offer a fresh perspective, which can be super helpful when you’re deep in the weeds of running your business.

They can spot things you might miss and offer advice that steers you clear of potential pitfalls. Plus, having that experienced financial mind in your corner can give you a lot more confidence when making big decisions.

It’s not just about saving money or making more; it’s about having a trusted advisor who helps you build a better, more resilient business for the long haul.

You’re getting strategic guidance that can make a real difference, not just today, but for years to come.

So, What’s the Takeaway?

Alright, so we’ve talked a lot about what a fractional CFO is and what they do. Basically, they’re like a super-smart financial helper you can bring in when you need them, without having to hire someone full-time.

Think of them as that expert friend who knows all about money stuff, ready to jump in for specific projects or just to give you a hand with big financial decisions.

Whether your business is just starting out or already chugging along, having someone with that level of financial know-how on your side, even part-time, can make a huge difference.

It’s a flexible way to get top-tier financial strategy without breaking the bank, helping you steer your company toward its goals.

Frequently Asked Questions

What exactly is a fractional CFO?

Think of a fractional CFO as a super-smart financial helper for your business, but they don’t work there full-time. They’re like a financial expert you can hire for a few hours a week or for a specific project. This means you get all their great ideas and experience without having to pay for a full-time executive, which can save a lot of money.

What does a fractional CFO do?

A fractional CFO services helps businesses with their money matters. They can help fix money problems, plan for the future to make the company grow, or offer new ideas to make things run better. They’re really good at looking at the numbers and helping you make smart choices about where your money goes.

When should a business hire a fractional CFO?

A business might hire a fractional CFO when they have tricky money issues they can’t solve on their own, or when they’re planning for a big step like getting more investment or selling the company. It’s also helpful if the current finance team needs extra support or a fresh point of view.

What are the main services a fractional CFO offers?

Fractional CFOs help with planning for the future, figuring out how to get money from investors, managing cash so the business always has enough, and making sure the company is making as much money as it can. They basically help steer the financial ship.

Is a fractional CFO service a good investment?

Yes, often it is! You get the brainpower of a top financial expert without the huge cost of a full-time employee. This can help your business make better money decisions, grow more steadily, and become more successful in the long run.

How is a fractional CFO service different from a full-time CFO?

A full-time CFO is a permanent employee who handles all the financial tasks for one company. A fractional CFO is more like a consultant who works part-time for several companies, offering specialized help when and where it’s needed most. It’s about getting expert help without the full-time commitment.